5 Experts Share Their Water Damage Insurance Tips for 2025

Have you ever faced the headache of unexpected leaks or flooding in your home? Dealing with water damage can feel overwhelming, especially when you’re unsure about your water damage insurance. Whether it’s a burst pipe or a relentless rainstorm, knowing you’re protected is crucial. That’s why understanding your coverage can save you time, money, and stress. But what exactly does your policy cover, and how can you ensure you’re fully protected?

Imagine waking up to a flooded basement, only to realize your insurance doesn’t cover water damage caused by rain or a faulty appliance. Therefore, exploring different insurance solutions can help clear up any confusion. From home and flood insurance to understanding your responsibilities and potential risks, it’s important to know what steps you can take to protect your property effectively. After all, navigating insurance claims isn’t just about having coverage; it’s about having the right coverage that safeguards your home and belongings.

Don’t leave your home unprotected! Dive into the insights from experts who offer practical tips for 2025. Make sure you’re ready for any water-related incidents that come your way with the right insurance solutions. Read on to uncover valuable advice from seasoned professionals on how to secure your home against water damage.

Photo provided by Sergey Meshkov on Pexels

Throughout the article

- Understand Your Water Damage Coverage

- Choose the Right Insurance Solutions

- Review Home Insurance Regularly

- Top Tips for Water Damage Insurance

- File Water Damage Claims Quickly

- Explore Comprehensive Disaster Coverage

- Finding the Best Insurance Benefits

- Invest in Comprehensive Flood Insurance

- Understand Property Insurance Differences

- Evaluate Insurance Policies Annually

Understand Your Water Damage Coverage

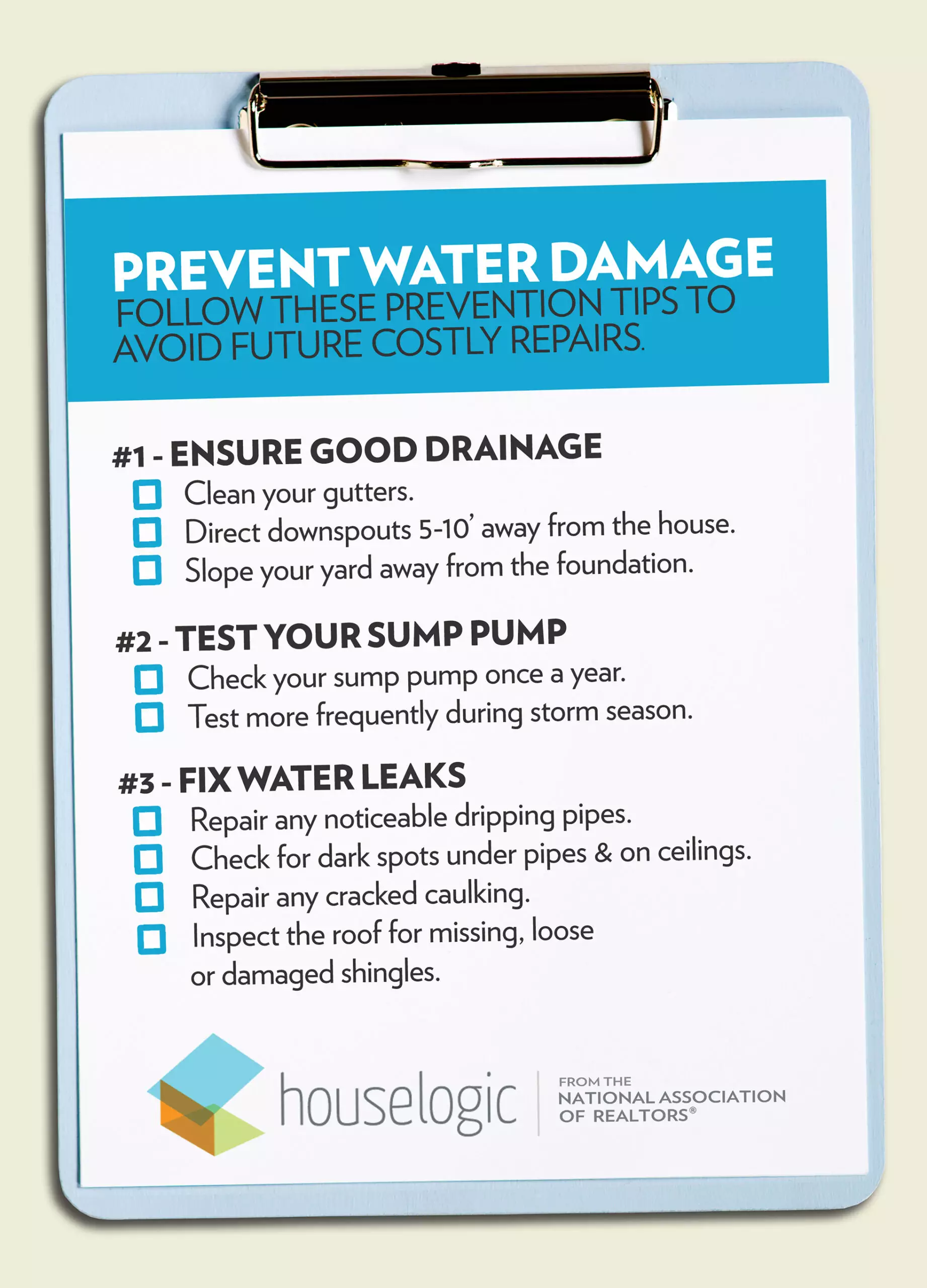

When you think about water damage insurance, it’s important to know what parts of your home are covered and what aren’t. Most policies cover sudden and accidental water events. However, they might not cover damage due to maintenance issues. For example, if a pipe bursts and floods your basement, you are likely covered. But if the damage comes from a slow leak over several months, you might not be. It’s crucial to review the details of your policy so you understand what is covered under your current plan.

Photo provided by Helena Jankovičová Kováčová on Pexels

Choose the Right Insurance Solutions

Selecting the right insurance solutions for your home can be challenging. You should look at different types of coverage and see which fits your needs best. Not all insurance policies are the same. Some may include coverage for flooding, while others do not unless you add it. You should consider customizing your policy to cover specific risks you face. For instance, if you live in an area prone to flooding, flood insurance is essential. Make sure you choose a policy that offers the right protection for potential water-related incidents.

Review Home Insurance Regularly

It’s wise to check your home insurance policy every year. This ensures your coverage still meets your needs. Over time, your circumstances might change. You might do renovations or buy expensive items that need more coverage. Reviewing your policy can help you find gaps in your coverage. Plus, updating your policy can sometimes lead to better rates. Keeping your insurance updated means you won’t face surprise costs if something goes wrong.

Photo provided by Mikhail Nilov on Pexels

Top Tips for Water Damage Insurance

Follow these expert tips to ensure you have peace of mind with your water damage insurance:

- Document everything with photos and notes.

- Install a water shutoff device for safety.

- Keep records of past water damage incidents.

- Understand the water damage claims process.

- Talk to your insurance agent for advice.

File Water Damage Claims Quickly

If water damage occurs, you need to file your claims as soon as possible. Speed is crucial in claim processing because the sooner you file, the sooner you might get help. When you file your claim, ensure you give all the necessary details about the incident. This includes the type of water damage and what caused it. Clear information can speed up the process and help you get what you need faster.

Explore Comprehensive Disaster Coverage

For thorough protection, you should look into comprehensive disaster coverage. This doesn’t just cover water damage but also other disasters like fires or storms. You might live in an area where these natural disasters occur regularly, so this kind of policy can be very valuable. Comprehensive coverage might cost more, but it can save you a lot of money and stress in the long run.

Photo provided by Nothing Ahead on Pexels

Finding the Best Insurance Benefits

Maximizing your insurance benefits involves comparing different providers. Each company offers distinct advantages, and it’s wise to shop around. Look for policies that provide the most coverage for the best price. Also, consider the customer service reputation of the company. You want a provider who is easy to contact and helpful when you need them. Comparing providers can help ensure you are getting the best value for your water damage insurance.

Photo provided by Soly Moses on Pexels

Invest in Comprehensive Flood Insurance

If you live in a high-risk area for floods, investing in comprehensive flood insurance is essential. Standard homeowners insurance often doesn’t cover flood damage. You should evaluate your flood risk seriously and choose a policy that covers possible flood scenarios. This type of insurance can protect your home from severe financial loss due to flooding.

Photo provided by Helena Jankovičová Kováčová on Pexels

Understand Property Insurance Differences

There are many types of property insurance, and knowing the differences is important. Some cover specific perils like fire or theft, while others are broader. Water damage insurance can be part of a broader policy or stand alone. Learn about what each type offers and how it protects your home. This knowledge ensures you pick the best option for your situation.

Photo provided by Sergey Meshkov on Pexels

Evaluate Insurance Policies Annually

Each year, you should evaluate your insurance policies. Adjusting your coverage as needed ensures it meets your current lifestyle and property value. Your needs may change, and your insurance should change with them. During this evaluation, you might find better options or discover ways to save money. Keep your coverage relevant by refreshing it annually.

Wrapping Up Your Water Damage Preparedness

Understanding coverage options can save you time and stress when accidents happen. Having the right plans means peace of mind and quicker recovery. You now know how experts handle these situations, which gives you an edge in protecting your home.

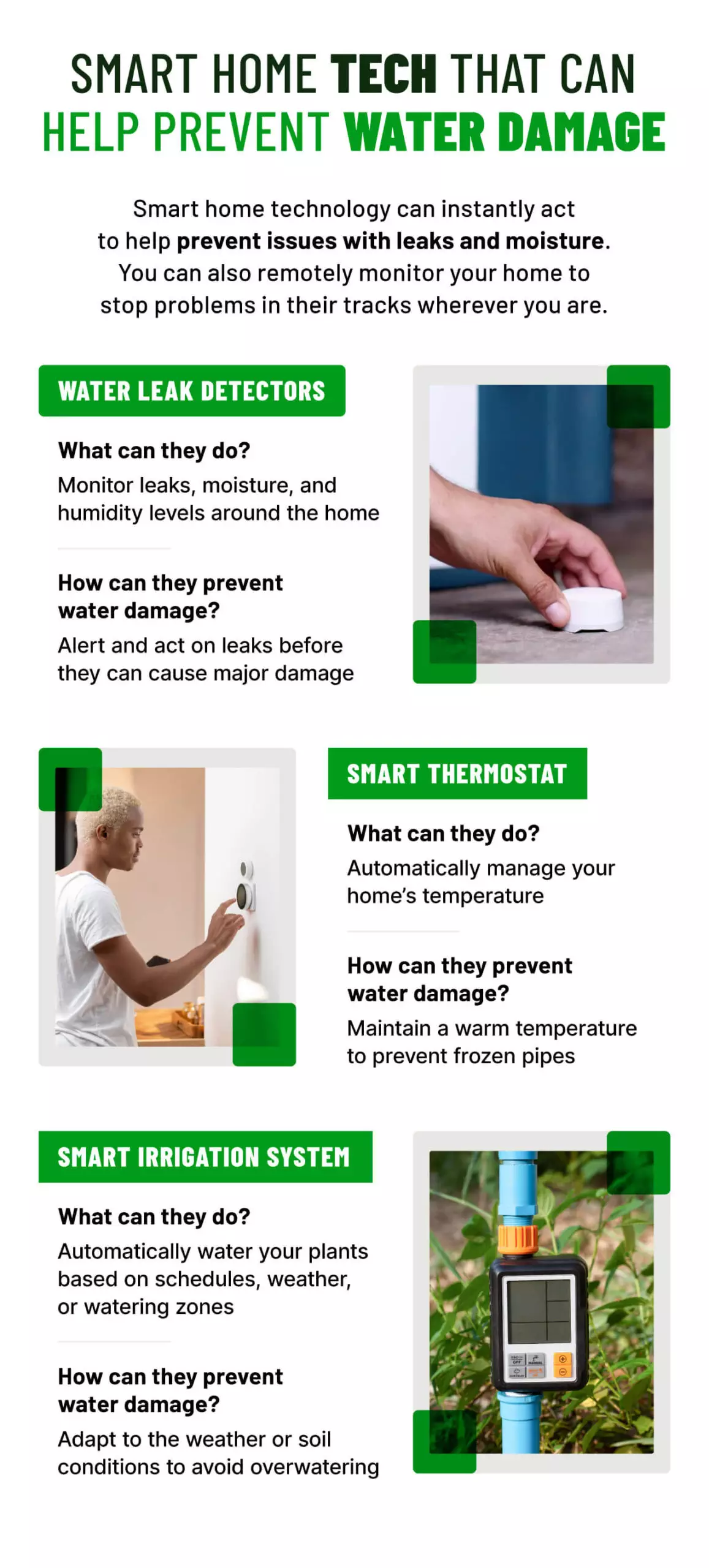

Take a moment to review your current insurance policies. Make a list of questions and reach out to your insurance agent for clarity. Consider installing water sensors and shutoff devices to prevent damage before it starts. These small steps can make a big difference.

Stay proactive with your home insurance. Contact your insurance agent today to ensure your coverage fits your needs. Protect your home, and let peace of mind be yours. You’ve got this!